Using Annuities To Fund Long Term Care Insurance

May 16, 2024

Written By Jack Lenenberg

As you are aging and with long term care costs escalating to over $100,000 annually, a common concern you may have today is "How am I going to pay for my future long term care costs?"

It might be natural for you to look at your balances within your retirement accounts or your non-qualified deferred annuities as possible sources of funds for future long term care expenses.

However, retirement accounts and non-qualified annuities grow on a tax deferred basis, so distributions from your IRA's and your tax deferred annuities are taxable events. Using these tax deferred accounts for future health care costs might not be the most tax efficient source of funds for you.

Today, however, you have tax planning opportunities.

In 2010, the Pension Protection Act (PPA) was enacted as US Federal Law and one of its key benefits is the significant changes it brought forth to the tax treatment of annuities with long term care benefits. Before the PPA, you had to pay taxes on the growth inside of your annuity before paying long term care expenses. The Pension Protection Act now allows long term care annuities, if compliant with the PPA, to be used to pay for long term care expenses tax free.

Thus, today you have a great opportunity to use PPA compliant LTC annuities to fund your future long term care expenses on a tax free basis.

Long Term Care Annuities Under The Pension Protection Act

The Pension Protection Act's provisions support funding long term care in two important ways.

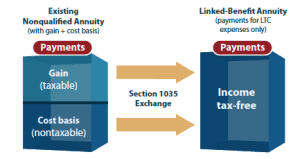

1. The PPA allows you to exchange tax-free (1035 exchange) non-qualified deferred annuities for long term care insurance.

2. PPA compliant annuities must include a long term care rider. If you own a PPA compliant annuity, your annuity cash value is tax-free if used for your long term care expenses.

What is a Long Term Care Rider?

A long term care rider is an option you can include on your annuity contract (or your life insurance policy) to allow you to withdraw your cash value should you be chronically ill, which means having a severe cognitive impairment (e.g. Alzheimer's or dementia) or being unable to perform at least 2 of 6 Activities of Daily Living (ADLs) which are self-care tasks > bathing, eating, dressing, toileting, transferring, continence.

Your Planning Opportunity

If you no longer need all of your savings or assets for retirement income needs, it might be time to consider repositioning a portion of your nest egg for extended care needs.

The passing of the Pension Protection Act brought forth special long term care annuities that will offer you the ability to immediately triple or quadruple your premium deposit for long term care needs.

I even have one long term care annuity policy that will provide Lifetime Unlimited long term care benefits, if needed.

Let's take a look at a few examples of long term care annuities.

I worked recently with Bill, a 69 year old widower in California that was sitting on an old annuity with approximately $200,000 in cash value. Bill had purchased this annuity 32 years ago for $30,000 so his taxable gain was $170,000. Bill had earmarked this annuity for his long term care needs. In discussing his plan with me, Bill was surprised to learn that he could complete a Section 1035 tax-free exchange of his old annuity into a long term care annuity which would still continue to accumulate growth and immediately remove all current and future taxable gains on his growth if he should use the annuity for long term care.

Bill's comment to me when I explained the long term care annuity tax advantages of the Pension Protection Act to him was "this is a no brainer, why wouldn't I do this?"

And he was correct. It is a no brainer.

Many people are sitting on older non-qualified annuities that have significantly grown tax-deferred for years. At some point, taxes on the gains will have to be paid when the cash value is distributed.

If you are one of these annuity owners that has an existing annuity with large gains, you can exchange your current annuity for a PPA compliant long term care annuity and all of your investment gains will be tax-free if used for care.

In Bill's case, the $200,000 of cash value would be able to be used tax-free for care at $8400 monthly until the cash value is depleted, and $170,000 of taxable gain is immediately washed away.

(Of course you are not limited to purchasing long term care annuities with existing annuities. You can also buy these annuities with cash savings or IRA rollovers)

The long term care annuities will usually accept premium deposits of any amount between $50,000 and $1,000,000. Issue ages can be up to age 87. Your long term care monthly benefit is directly correlated to the amount of your premium deposit.

And most importantly my underwriter is providing INSTANT APPROVAL with the answering of 5 knockout health questions.

Enhancing Your Long Term Care Annuity

Now, the above example is a very easy simple solution to immediately convert taxable gains into tax-free distributions for care.

There are also additional opportunities for you to consider with long term care annuities to enhance your long term care coverage even further should you need care.

The primary way for you can enhance your long term care annuity is through the election of continuation of benefits (COB) riders.

What is a Continuation of Benefit Rider?

A continuation of benefit rider is an optional benefit you include with your long term care annuity that will continue to provide you with monthly long term care benefits after your annuity cash value has been used entirely for long term care needs.

Most long term care annuities will provide optional continuation of benefits for you such that your annuity will provide you with long term care benefits for 6 or 8 years, or even for your entire Lifetime.

Let's revisit the plan of Bill above. Bill owned an annuity with approximately $200,000 of cash value. If Bill buys a long term care annuity without a continuation of benefits rider Bill will receive approximately $8400 month for 24 months for care needs ($200,000 divided by 24 = $8333) and the annuity will be exhausted.

But what if Bill needs care for longer than 2 years?

Long term care can be needed for a long time, especially with cognitive impairments such as dementia and Alzheimer's, and diseases such as Parkinson's.

So, Bill and I discussed a few options to enable his annuity to provide long term care benefits for extended time.

One option Bill and I discussed was to elect to pay a small fixed and guaranteed monthly premium that would extend his $8400 monthly long term care benefit for his entire lifetime. In Bill's case, the monthly premium was about $450 month, and if Bill ever needed care the small $450 monthly premium would be waived.

A 2nd option we discussed was to not have any additional ongoing out-of-pocket premiums and to simply immediately double (2x), triple (3x) or quadruple (4x) his premium deposit of $200,000.

Bill considered the quadruple of $200,000 to $800,000 for long term care. Through the quadruple of his premium, Bill would receive 8 years of monthly benefits of $8400 month, if care is needed ($800,000 divided by 96 months +$8333).

With this approach, the COB Rider costs are paid out of Bill's annuity cash value. While 8 years of benefits is not Unlimited, it still is a long enough period of time to provide peace of mind for Bill and his children.

So, these are a few ideas for you to also consider with enhancing your long term care annuity.

Here are the illustrations of the ideas that Bill and I reviewed together.

Lifetime Unlimited LTC Benefits

Quadruple of Your Annuity Premium

Ultimately, Bill liked best the idea of the long term care annuity policy with Lifetime Unlimited long term care insurance benefits.

Getting Health Approved For Long Term Care Annuities

Unlike the underwriting for traditional long term care insurance or linked benefit life/long term care insurance policies, getting approved for long term care annuities is much easier.

Typically, your only underwriting requirement is a telephone health interview that will include a cognitive screening exercise.

Exams are not required, and generally medical records will not be ordered for review.

If you have been declined for long term care insurance before and believe that you can't get coverage, you might be surprised to find out that you can receive coverage through the LTC annuity approach.

I often will obtain underwriting approval for my long term care annuity clients within 3 days. Once approved, you will have 60 days to mail in your premium payment.

Start Planning For Long Term Care Today

I will be pleased to help you with exploring your long term care planning options to find your best solution for you.

As an independent specialist with 27 years of experience, I will help guide you to your best planning options whether it is traditional stand-alone long term care insurance policy, a hybrid life/long term care policy or an LTC annuity.

We work with the leading A+ rated underwriters in the arena including Nationwide, Lincoln Financial, OneAmerica, Mutual of Omaha, Brighthouse and Securian.

Please call me directly at (800) 891-5824 or you may book a call with me online.

Thank you for reading my blog.

Jack Lenenberg, J.D.