Using Annuities To Pay For Long Term Care

With the continued march of the baby-boomer generation into retirement, the need for long term care planning will continue to rise. Consumers such as you will continue to search for attractive solutions to fund your future care needs.

The premiums for traditional long term care insurance have increased since 2012, thus stagnating the sales of stand-alone long term care insurance policies. Meanwhile, sales of hybrid combination products such as life insurance/LTC policies or annuity/LTC policies have soared with more than $4 Billion in sales in 2017.

Why the appeal?

With traditional long term care insurance you may pay an ongoing premium for years and never need to receive benefits.

With the alternative of cash value hybrid long term care policies, whether life-based or annuity-based, you are guaranteed to receive at a minimum the return of your cash value even should long term care care not be needed by you.

So, you avoid the use-it-or-lose-it proposition of traditional LTC insurance policies.

The popularity of the hybrid LTC annuity combination policies is an outgrowth of the Pension Protection Act of 2006 that now allows consumers to withdraw gains out of non-Qualified annuities tax-free for long term care costs, such nursing home, assisted living, adult day care and qualified home care expenses.

How Do Long Term Care Annuities Work

Like most people, you have worked hard your whole life. It is likely you have accumulated assets for two reasons:

- To enjoy during your lifetime

- To leave a legacy for your loved ones or to your favorite charities.

However your assets could be placed in jeopardy should you ever need long term care

Reallocating your existing assets like cash, savings, CDs, or other annuities into a combination annuity and long term care policy will help to maximize your assets if you need to pay for long term care expenses.

Long term care annuities will help to leverage your assets into 3X, 4X or 5X your principal investment should you need care.

This retirement strategy will help you to protect your retirement income stream from significant long term care costs.

Let's take a look at an example of how a long term care annuity works.

Hybrid long term care policies --whether based on annuity cash value or life insurance cash value--work in the same manner.

There are two phases:

- Acceleration of Cash Value Benefits - This is the payout of your cash value to you on a monthly basis, typically over 2 years.

- Extension of LTC Benefits Rider - This is the continued payout to you after your principal cash has been exhausted, typically for an additional 3, 4, 5 or 6 years, or for your entire Lifetime depending upon your policy.

Example of a LTC Annuity Plan

Let's say you are a 65 year old female and you have $100,000 available that is not needed for your retirement income.

You could elect to re-position this $100,000 into a combination fixed annuity with long term care benefits for an 8 year benefit period.

Your long term care annuity benefits could be the following:

| Cash Value | COB Balance | Total LTC Balance | |||

| Age 66 | $101,468 | $304,405 | $405,873 | ||

| Age 70 | $107,388 | $322,164 | $429,552 | ||

| Age 75 | $114,840 | $344,520 | $459,360 | ||

| Age 80 | $122,265 | $366,796 | $489,061 | ||

| Age 85 | $129,559 | $388,679 | $518,238 |

With this approach, you could leverage your $100,000 cash value into $400,000 to $500,000 tax-free dollars that can provide you with $4000-$5000 month for 8 years should you need long term care.

If long term care is not needed, you could still leave your $100,000 cash value to your loved ones or to your favorite charity.

Additionally, if you change your mind and wish to cancel your policy you could receive your money back too.

Here is a link to the illustration for the above example.

Long Term Care Annuity Illustration

As with all long term care insurance policies, these hybrid LTC annuities have different options with regards to your chosen benefit period and optional inflation protection.

Should you wish to include inflation protection you will reduce your immediate cash value, while increasing your future long term care benefits.

Here is an example of a long term care annuity policy for a 65 year old with $100,000 premium with inflation protection of 5% compound on the Continuation of Benefits Balance. With the inclusion of the inflation protection the leverage for you might be 7X your deposit in your 80's!

| Cash Value | COB Balance | Total LTC Balance | |||

| Age 66 | $89,911 | $269,733 | $359,644 | ||

| Age 70 | $95,156 | $322,780 | $417,936 | ||

| Age 75 | $101,759 | $411,959 | $513,718 | ||

| Age 80 | $108,339 | $525,776 | $634,115 | ||

| Age 85 | $114,802 | $671,038 | $785,840 |

Below is the link for the inflation adjusted LTC Annuity illustration

Long Term Care Annuity Illustration with 5% Compound

Tax Advantages of Long Term Care Annuities

Not only will long term care annuities enable you to receive significant leverage on your principal dollars, but also your leverage will be completely tax-free.

Not only will long term care annuities enable you to receive significant leverage on your principal dollars, but also your leverage will be completely tax-free.

Tax-free access

The Pension Protection Act of 2006 provides that all distributions from non-qualified annuities for qualified long term care expenses are tax free, regardless of cost basis whether the distributions are from your cash value component of your annuity or from your annuity's long term care extension of benefits provision. These income tax-free withdrawals will allow you to protect your retirement by guaranteeing you that you have funds available for long term care expenses.

Tax-free movement

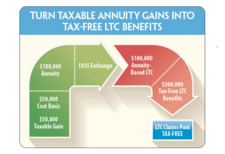

Section 1035 of the Internal Revenue Code provides that you will incur no taxation or tax penalty through the exchange of an existing annuity contract into a long term care annuity policy through a Section 1035 Exchange.

Planning Opportunity

Do you have a non-qualified tax deferred annuity that has a sizable gain? If you distribute money out of your annuity, the gain will come out first (Last In, First Out rules apply), and you will be taxed at ordinary income.

You may not want to create a taxable event by taking distributions out of your gain inside of your annuity.

To avoid taxes, you could elect to complete a tax free 1035 exchange of your non-qualified annuity into a combination long term care annuity. With your new annuity policy, should you need long term care, the Pension Protection Act will now allow you to wash away all of your taxable gain if your distributions are for long term care expenses.

Streamlined Underwriting

One nice advantage of hybrid annuities is that your health history is less likely to prevent your application from being declined.

Unlike traditional long term care insurance applications that will require a comprehensive review of your medical records, or even the hybrid LTC and life insurance policies that will also have somewhat stringent health underwriting guidelines, the long term care annuities are much easier for you to receive approvals by the underwriters.

If you have applied for long term care insurance in the past and have been declined, you very well may be able to be approved for these policies! Call us to day to find out.

Request Customized Long Term Care Insurance Illustrations Today

We work with the leading long term care insurance underwriters including OneAmerica, Lincoln Financial, Mutual of Omaha, Pacific Life, Minnesota Life, Transamerica, Nationwide, Thrivent, Global Atlantic, National Guardian Life and more. Call us today at (800) 891-5824 to receive your customized illustrations and comparisons.