Best Long Term Care Insurance Policies For Your Money In 2018

Wow, how time flies. For years, my readers have been asking me to update my Top 10 List of Best Long Term Care Insurance Policies originally published in 2013.

Wow, how time flies. For years, my readers have been asking me to update my Top 10 List of Best Long Term Care Insurance Policies originally published in 2013.

We have seen a few changes in the long term care insurance marketplace in the past 5 years.

A few notable long term care insurance companies such as John Hancock, State Farm, and MedAmerica have left the arena.

New underwriters such as Securian Financial and National Guardian Life have entered in their place with well-priced options.

The most notable change I have witnessed however in the past 5 years has been the rising popularity of hybrid LTC policies which combine long term care insurance with cash value life insurance or annuity policies, for fixed guaranteed premiums.

Now, regardless of which policy type you prefer for yourself: the traditional LTC insurance policy or the hybrid long term care policy approach, you still deserve to obtain a strong LTC insurance policy of value.

Keep in mind: there are very good traditional long term care insurance policies in the marketplace as well as lousy traditional policies.

Likewise, there are very good hybrid long term care insurance policies in the marketplace, and there are absolutely lousy hybrid policies too.

Considering that the cost of your policy today will not be an inexpensive proposition, you certainly deserve to be treated fairly.

3 Long Term Care Insurance Features You Deserve To Own

- Strong Highly-Rated Company

- Benefit-Rich Policy

- Educated & Experienced Agent

I know you will agree with me that these 3 basic benefits are not too much for you to expect as a consumer.

Certainly, you deserve your insurance company to be financially strong and solvent. You need to know and feel comfortable that your insurance company will be around for you at claim-time when you need it to be there.

Additionally, should you make a claim you need to know that your policy will provide you with benefits of value to you. Your role is not to provide the insurance company with a free ride on your premium. You deserve to receive maximum leverage on your premium outlay so that should you make a claim your retirement assets and income are protected as much as possible.

Lastly, you deserve an experienced and knowledgeable agent adviser. You deserve an adviser that can answer all of your questions, and provide you with proper advice and direction. Your agent comes for free. Choose wisely, and you will receive maximum insurance value. Choose poorly, and your agent will come at a cost to you. Unfortunately, my clients have expressed to me that their financial advisers do not know very much about long term care insurance.

If you obtain these 3 benefits with your long term care insurance - strong company, good policy, great agent - you will be in a very good position.

How To Find The Best Long Term Care Insurance Policy

Often, I receive questions such as: How do I qualify for benefits with each policy? Is Alzheimer's covered? Are pre-existing conditions covered?

The good news is that in 1996 the Internal Revenue Code standardized benefit-trigger language, mandated coverage and eliminated prior loopholes under all tax-qualified long term care insurance policies under IRC 7702(b). You no longer have to be concerned that you will meet the definition as being chronically ill or cognitively impaired under one policy, but you will not meet the definition under another contract.

So, the benefit trigger language is standardized. Policies are fairly cookie-cutter in this regard.

And all of the major policies will provide benefits to you in all settings: home care, assisted living facilities, adult day care centers, nursing facilities.

So, how will your policy choices be different from each other?

Well, long term care insurance policies will differentiate from each other on 4 primary factors:

- Cost Of Insurance

- Policy Type: Traditional or Hybrid

- Policy Payout Model: Cash Indemnity or Reimbursement

- Ancillary Policy Contractual Language Flexibility

Policy Cost

Cost of insurance will always be your primary issue to address.

When you buy long term care insurance (regardless of whether you are reviewing a traditional policy or a hybrid policy) you are buying an amount of long term care insurance money, plain and simple. All long term care insurance policies are comprised of a daily or monthly benefit, a benefit period multiplier (number of years), and an optional inflation factor to grow your money.

You are buying an amount of insurance money + growth. Your insurance company is charging you a premium.

So, a Lifetime benefit period is better for you than a 6 year benefit period. A 6 year benefit period is better for you than a 4 year benefit period.

5% compound inflation protection is better for you than 3% compound inflation protection. 3% compound inflation protection is better for you than an automatic purchase option.

Insurance premiums are based upon age, marital or partner status, and health. You need to be aware that insurance company cost of insurance will vary greatly across the board, especially for women and for your inflation protection options.

You want to buy the most insurance benefit for the least amount of premium with a highly-rated company.

Policy Type

You will have to decide which policy type you are attracted to.Traditional policy premiums are less expensive, however the premiums are not guaranteed. Hybrid policy premiums are higher, however you receive a return of premium through your cash value if care is not needed. And your premiums are fixed or guaranteed.

Either type of policy can work for you. Just determine how much long term care benefits you want for yourself: benefit period, monthly benefit and inflation protection.

Policy Payout Type

The vast majority of long term care insurance policies are reimbursement models. With reimbursement policies you submit receipts, and you are reimbursed for your out-of-pocket expenses up to your monthly benefit limit.

There are a limited number of cash indemnity policies available. With cash indemnity policies, you are not required to submit receipts to receive your full monthly benefit. Obviously, cash policies will be easier for you at claim-time and will possibly provide you with covering a greater array of informal home care needs.

Policy Contractual Language

You will find that some policies have more flexible contractual language than other policies.

For example, some policies will count your elimination period days by dates of service (restrictive), while other policies may count the elimination period days as calendar days (best). Some policies may allow you to use home caregivers independent of agencies (best) while other policies may require you to use home care agencies (more restrictive). Some policies may provide international coverage, other policies may limit you to the United States.

Often, these contractual differences will serve more as tie-breakers rather than deal-breakers.

Best Long Term Care Insurance Policies For Your Money

This being said, in my researching all of the long term care insurance policies available for my clients the following policies should be on your short list as the best LTC policies to consider today.

So, without further adieu these policies are the absolute "Best of Breed" long term care insurance policies for 2018.

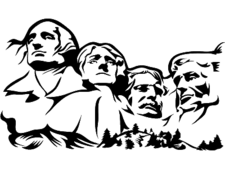

These (4) long term care insurance policies are on my Mount Rushmore today. These policies are the very best policies because each policy brings something unique and different to your table to separate it from the typical average long term care insurance policy offering.

These (4) long term care insurance policies are on my Mount Rushmore today. These policies are the very best policies because each policy brings something unique and different to your table to separate it from the typical average long term care insurance policy offering.

- Mutual of Omaha Custom Solution/Secure Solution

- OneAmerica Asset Care

- Securian SecureCare

- OneAmerica Annuity Care II

Best Traditional Long Term Care Insurance Policy

Mutual of Omaha Custom Solution & Secure Solution policies

What Makes It Different?

Mutual of Omaha offers the best traditional long term care insurance contracts in the marketplace by far. The policy language flexibility within the Mutual of Omaha LTC policies is terrific. Mutual of Omaha is one of the few long term care insurance companies that still contractually allows you to hire home caregivers that are independent of home care agencies. The elimination period is calculated as calendar days, rather than service days. Monthly reimbursement model rather than daily reimbursement. It's Shared Care rider will allow you to extend benefit periods to as long as 16 years with your partner. Not Unlimited beneifts, but very close.

With the Custom Solution policy, a 40% Cash Alternative Benefit is built-in that you can turn-on or turn-off each month according to your needs. Inflation protection options may be customized in any factor with 1/4 % increments, and you can also buy-up or buy-down your inflation protection over the years.

The Mutual of Omaha pricing is as good as it gets for consumers.

The Mutual of Omaha premiums have been stable for policy series issued 2007-2018.

Bonus points for allowing 100% of your benefits to be used in Canada and in the United Kingdom.

Mutual of Omaha is A+ Rated by AM Best

Best Hybrid Long Term Care Insurance Policy

OneAmerica (State Life) Asset Care Policy Series

What Makes It Different?

Unlimited long term care insurance benefit periods!

Unlimited long term care insurance benefit periods!

With OneAmerica long term care planning is still long term care planning. The unlimited lifetime long term care benefit period is still the core benefit of its offerings. While practically every other long term care insurance underwriter has rendered long term care insurance to medium-term care or short-term care insurance with benefit period availability ranging from 2 years to 6 years, OneAmerica still understands the needs of its policyholders. With cognitive impairments such as Alzheimer's and dementia; Parkinson's disease, and stroke for example, your risk of needing long term care for greater than 3-5 years is real. With the OneAmerica Asset Care policy you will never have to worry about exhausting your insurance coverage.

Joint Life Policy

OneAmerica has a patent on joint life for hybrid long term care policies. With this patent, OneAmerica Asset Care is the only hybrid long term care policy that will cover two insureds with a single policy. Spouse, partners, siblings can all take advantage of the premium savings with the joint life policy.

Direct rollovers of qualified funds is acceptable

The Asset Care III policy will accept rollovers of IRAs, 401(k)s, 403(b)s, and TSAs. OneAmerica Asset Care III is the only hybrid life LTC insurance policy that will accept qualified retirement accounts to fund the plan.

Flexible installment payment options

Most hybrid long term care insurance policies will require funding as a single premium or installment payments within 10 or 15 years.

OneAmerica Asset Care accepts single premiums or installment payments over 10 years, 20 years or for lifetime.

You can also combine these payment options so a portion of your policy can be paid as a single premium, for example; and the remainder can be paid-in over a period of time such as 10 or 20 years; or lifetime.

Wide Range Of Inflation Protection Options

2% compound, 3% compound, 4% compound, and 5% compound are available

OneAmerica (State Life) is A+ Rated by AM Best

The OneAmerica Asset Care policy is simply the perfect hybrid long term care policy. Lifetime unlimited benefits. Joint life availability. Flexible funding options. Wide range of inflation protection options.

Best Cash Indemnity Long Term Care Policy

Securian (Minnesota Life) SecureCare policy

What Makes It Different?

Cash Indemnity Benefits

What Makes It Different?

Cash Indemnity Benefits

Practically every long term care insurance policy available for you to consider will be a reimbursement policy. You will be required to submit receipts for your out-of-pocket expenses and your insurance company will reimburse you for your loss. There is nothing necessarily wrong with this approach.

An indemnity policy however will possibly easier for you, and the indemnity policy might cover some out-of-pocket costs that might not meet the definition of a qualified care expense under a reimbursement policy.

Cash indemnity policies are very rare and indemnity policies can be expensive for you to buy.

Why? Because your insurance company believes there will be a much greater potential for fraud with cash indemnity policies.

However if you want to eliminate the hassle of submitting receipts and receive the utmost flexibility in having your care needs covered, the cash policy ill help you.

The challenges are two-fold: 1) finding an available cash policy; and 2) paying a fair price for it

Today, cash indemnity LTC policies are limited in availability: there are only two 100% cash indemnity polices available today: Securian Secure Care and Nationwide CareMatters. A 3rd policy, Pacific Life Premier Care, will offer you 80% cash, not 100%.

Of these (3) indemnity policy options, Nationwide Care Matters is simply a god-awful policy value. Just not worth buying.

The Securian SecureCare cash indemnity policy, however --- well, Securian's pricing is market competitive!

For individual hybrid long term care insurance policies, Securian SecureCare is priced just as good or better than much of its competition such as Lincoln Moneyguard III or Pacific Life Premier Care Choice. And with Securian SecureCare you will receive 100% cash! No receipts.

You can't beat that.

Securian (Minnesota Life) is A+ Rated by AM Best

Best Hybrid Long Term Care Annuity

OneAmerica Annuity Care II

What makes it different? Excellent Leverage

An alternative to the life insurance based hybrid policies are the annuity based LTC hybrids.

An alternative to the life insurance based hybrid policies are the annuity based LTC hybrids.

Hybrid long term care annuity policies might serve a beneficial purpose for you if you looking to purchase long term care insurance benefits and you fall within the right profile that these policies are intended for.

Hybrid LTC annuities will benefit you in 3 specific circumstances:

- If you own a non-qualified annuity with a sizable taxable gain that you wish to avoid paying tax on; or

- If you are in sub-optimal health such that you will benefit from reduced medical underwriting; or

- If you are an older age, say 70 years old +

The typical hybrid annuity will triple your principal your premium deposit for long term care needs. If you deposit $100,000, the annuity contract will provide you with $300,000 for long term care.

The OneAmerica Annuity Care II policy has the ability to offer you even more leverage than just 3x your deposit.

Annuity Care II can offer you multipliers as high as 4x or 5x your premium deposit.

Additionally, the Annuity Care II policy also offers the gold standard of 5% compound inflation protection as its inflation protection option. With 5% compound inflation protection built-in to this policy's benefits, you now have the very best hybrid LTC annuity option in the marketplace which will easily provide you with 7x - 10 x premium leverage.

OneAmerica (State Life) is rated A+ by AM Best

In my analysis these (4) policies are the utmost very best policy offerings today depending upon which type of long term care insurance policy you are looking for.

5 Long Term Care Insurance Policies To Avoid:

New York Life SecureCare traditional LTC policy

Northwestern Mutual Quiet Care traditional LTC policy

Mass Mutual Signature Care 600 traditional LTC policy

Mass Mutual CareChoice One hybrid

New York Life Asset Flex hybrid

Compare Your Best Long Term Care Insurance Options

I will help you to compare your best long term care insurance options from top-rated insurance companies. I work with the leading long term care insurance providers such as Lincoln, OneAmerica, Pacific Life, Mutual of Omaha, Securian, National Guardian, Transamerica, Nationwide, Global Atlantic, Thrivent and more. To receive customized illustrations and analysis please call me direct toll-free at (800) 891-5824. Or complete my LTC quote request form and I will reply promptly.

Thank you for reading my blog.