Lincoln Moneyguard II Combines Long Term Care Insurance and Life Insurance

Review of Lincoln Moneyguard II long term care insurance policy

Life insurance is a well accepted financial product to provide family protection. Almost everyone will own life insurance at some point in their life.

Long term care insurance, by contrast, is owned by only 9% of Americans.

Why is this?

Everyone knows the importance of having long term care insurance to help pay for your costs of care received either in your home or in a facility.

The cost of long term care care is expensive, currently averaging over $87,000 annually nationwide.

Without long term care insurance, you can easily spend through a lifetime of savings and end up on Medicaid. Buying long term care insurance enables you to not only remain independent; but also allows you to not burden your family with caregiving issues.

So, why doesn't everyone buy traditional long term care insurance?

Typically, I receive 2 basic concerns.

- What if I pay premiums and never need long term care?

- What if my premiums increase and I can't afford my coverage when I'm older?

Several large life insurance companies such as Lincoln National Life, OneAmerica (State Life) and Pacific Life have recognized and addressed these concerns with insurance policies that combine guaranteed long term care benefits with a guaranteed life insurance benefit for a guaranteed premium .

See Also: Shift To Hybrid LTC Policies Expected To Grow

One of the more popular hybrid long term care insurance policies is Lincoln Moneyguard II.

September 16, 2019 Update: Lincoln Moneyguard II has been replaced by Lincoln Moneyguard III.

For the current 2020 review of the Lincoln Moneyguard III policy, please follow the link immediately below.

To see my answers to hundreds of consumer questions over the years, continue to the end of this review.

2020 Lincoln Moneyguard III Policy Review

Lincoln MoneyGuard II - How Does It Work?

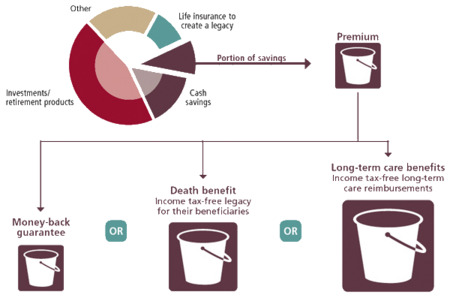

Linked benefit LTC policies such as Lincoln Moneyguard II provide tax-free long term care insurance if you need it; income tax-free life insurance benefits for your heirs if you don't need care; and a money back guarantee if you ever change your mind. These benefits are guaranteed and fixed for the life of the contract. The contract is usually funded with a one-time payment. There are no ongoing premiums.

Take for example a 60 year old married female that re-positions an asset of $100,000 into Lincoln Moneyguard II.

A deposit of $100,000 will immediately guarantee her almost $314,885 of tax-free long term care insurance benefits---$4057/month for 6 years---- if long term care is needed. The policy will also include automatic 3% compound inflation protection. At age 80 she would have $7327 month and $568,717 in her pool of money.

If long term care is not needed, a tax-free life insurance benefit of $115,000 is paid out to her loved ones.

If she changes her mind, the policy includes an 80% Return of Premium benefit.

Lincoln Moneyguard sample illustration married 60 year old female

(Lincoln Moneyguard II also has a 100% Return of Premium option with a 5 year vesting schedule)

Lincoln Moneyguard II - Is a Long Term Care Policy with Life Insurance Benefits Right For Me?

Linked benefit LTC policies such as Lincoln Moneyguard can make sense for many individuals.

The policies can be structured to provide fixed benefits; or designed to address inflation protection.

If you seek to protect your retirement assets from long term care costs, and have the ability to re-position an asset not needed for retirement income into a policy these hybrid policies make a lot of sense.

Lincoln Moneyguard II - How do I Qualify?

Please contact us at 1-800-891-5824 to review your health history to see if you can qualify for a hybrid long term care policy.

We find it is sometimes easier to qualify healthwise for linked-benefit policies than qualifying for a traditional long-term care insurance policy. The underwriting process with Lincoln Moneyguard II most often only consists of a telephone interview. Lincoln Moneyguard policies are usually issued 2 days after your telephone interview is completed.

Even if your prior long term care insurance application has been turned down, you might still qualify for a linked benefit policy.

We can help you fully explore your long term care planning options. We are an independent agency and have served consumers nationwide since 1998. We will help you sort through your options and answer your questions.

To receive and compare linked-benefit illustrations from the leading companies such as Lincoln Moneyguard II, State Life Asset Care, Pacific Life Premier Care Advantage, Securian SecureCare, please contact us at 1-800-891-5824 or complete our quote request form. We thank you for reading our LTC insurance blog.

Lincoln Moneyguard II introduced as next generation hybrid life-long term care insurance policy

Update: On March 14, 2014 Lincoln Moneyguard II (2) was introduced in many states. With the launch of this current hybrid life-long term care policy series, Lincoln has made a few changes. Lincoln Moneyguard II does not offer immediate 100% Return of Premium. Policyholders may now elect either a 100% Return of Premium option with a 5 year vesting schedule or an 80% Return of Premium option. With Moneyguard II, clients may select a variety of funding options with either a single premium option or payments funded over a flexible period of up to 10 years. Care coordination services are also now included within the Moneyguard II policy to allow policyholders access to local specialists that may assist in helping the policyholder chooses between a variety of informal and formal care options.

March 2017 Update: Lincoln announces rate increases on new business applications submitted after April 13, 2017

Lincoln has increased by 10% to 20% the premium cost of Moneyguard for new applications as of April 14, 2017.

Illustrations prior to April 14, 2017 are now invalid.

See also from my blog: Is this the perfect long term care policy?