Long Term Care Insurance State Partnership Programs

What is the Long Term Care Insurance Partnership Program?

The original Long Term Care Insurance Partnership program was developed in 4 States in 1992: California, Indiana, Connecticut, and New York.

With the number of elderly Americans growing at a rapid pace, long term care services comprise the largest portion of Medicaid expenditures in most States. Lawmakers recognized the need to reduce the burden of State Medicaid long term care expenditures.

The intent of the Long Term Care Partnership Program is to help States manage long term care costs, while at the same time offering consumers more affordable long term care coverage.

Through the purchase of Partnership Long Term Care Policies consumers are protected from having to "spend-down" their assets in order to qualify for Medicaid.

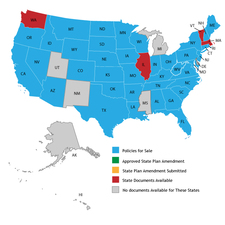

With the passage of the Deficit Reduction Act of 2005, Congress allowed for the expansion of Long Term Care Partnership Programs to other States. Today, 45 States have implemented Long Term Care Insurance Partnership programs.

The Rationale for the Long Term Care Insurance Partnership Program

The thinking behind the creation of long term care insurance programs is that these programs will:

- Reduce Medicaid Long Term Care Costs by encouraging people at risk for "spend-down" (or who would otherwise transfer assets to avoid spending down) to buy long term care insurance instead of relying upon Medicaid.

- Reward consumers by providing asset protection. If buyers of long term care insurance use up all of their policy benefits the policyholder will be allowed to access Medicaid long term care benefits without meeting the usual spend-down rules; and may retain assets on a dollar-for-dollar basis equal to the amount of long term care insurance policy benefits received. This is the asset disregard incentive.

Benefits of Long Term Care Insurance Partnership Policies

The primary benefit of owning a Partnership long term care policy is the Medicaid asset protection available to you once your long term care insurance benefits have been exhausted.

Without the purchase of a Partnership long term care insurance policy, your State would require you to spend-down your assets to $2,000 typically before you will qualify for Medicaid long term care benefits. Your State would also examine any transfer of assets within 5 years of your application for Medicaid applying a penalty period if asset transfers are found. Qualifying for Medicaid is difficult.

With the purchase of a Partnership policy, however, Medicaid will not require you to spend-down your assets to the $2,000 level.

Medicaid will disregard any of your assets equal to the benefits you received from your LTC policy.

Here is an example

Suppose you purchase $240,000 of Partnership-qualified long term care insurance-possibly a policy with a $5,000 monthly benefit and a 4 year benefit period. ($5,000 x 12 month x 4 years = $240,000).

Let's say you need long term care, and your Partnership long term care policy pays you $240,000 in benefits. If this happens, Medicaid will "disregard" $240,000 of your assets in determining whether you qualify for Medicaid. You will not be required to spend-down to $2,000. Thus, in this example you can keep $240,000 in savings or investments and will only have to spend-down to $242,000 ($240,000 of policy benefits + $2,000 Medicaid rules).

Thus, your Partnership long term care insurance policy helps you in 2 ways, really:

- Your assets are protected should you ever run out of insurance

- While you are receiving your insurance benefits, you have acquired the time to "figure things out", i.e. transfer assets, etc. should Medicaid ever be a foreseeable need

Buying a Long Term Care Insurance Partnership Policy

Long term care insurance policies must include certain features to be eligible for Partnership protection.

- Must be a Federally Tax-Qualified long term care insurance plan

- Must include inflation protection to keep up with the rising costs of long term care. This requirement makes sense because without the purchase of inflation protection consumers will be more likely to not have adequate benefits and ultimately place pressure upon State Medicaid expenditures that were hoped to be avoided in the first place.

- Must be filed as a Partnership Policy with the State

-----Policies issued to applicants below the age of 61 must include Compound Inflation Protection.

-----Policies issued to applicants between the ages of 61-75 must include some form of inflation protection.

-----Policies issued to applicants age 76 and older do not require inflation protection.

Also, in order to sell a Partnership long-term care insurance policy an agent is required to satisfy ongoing education and training requirements.

LTC Partner can help you explore your Long Term Care Partnership Program options. To learn more or to receive quotes of LTC Partnership Plan Policies please contact us toll-free at 800-891-5824; or complete our easy long term care insurance quotes request form.

Thanks for reading my blog

Jack Lenenberg