Call now for your free quote: 800-891-5824

Long Term Care Insurance Inflation Protection

Q: Why is it important to have inflation protection? What amount of inflation protection is recommended to keep up with rising health care costs?

The high cost of long term care is a huge issue of concern today.

The average cost for a nursing home in 2023 is approximately $108,000 per year. Generally, people tend to need care for an average length of time of 44 months, thus an average long term care expense might amount to nearly $350,000 out-of-pocket should care be needed today.

The main issue, however, is that the need to make a claim for most purchasers of this type of insurance is most likely 15, 20, 30 years away.

Long term care costs in facilities have typically increased an average of 3%-5% on an annual basis.

If costs increase, as projected, a 60 year old today will expect to pay approximately $800,000-$1,200,000/year 25 years from now when a claim is most likely to be made.

With simply needing care for an "average" length of time--3 to 4 years, a $1,000,000 nest egg will easily be eroded.

You will want a bare minimum of automatic annual 3% compound inflation protection on your policy to help you keep pace with increasing health care costs.

The Benefit of Having Inflation Protection

A policy with automatic inflation protection, sometimes called an automatic benefit increase rider, increases your long term care insurance benefits automatically each year. A long term care insurance policy without inflation protection essentially decreases in value, on an inflation-adjusted basis, every year the actual cost of long term care increases.

Differentiating between the various forms of inflation protection is critical in determining which type of inflation protection is best for your needs.

Automatic Inflation Protection in Long Term Care Insurance Policies

Simple Inflation Protection

Simple inflation protection is interest on the original daily benefit only.

For example, with 3% simple interest a daily benefit of $200.00 will increase by $6/day on each policy anniversary. For a 55 year old applicant a $200/day benefit will be worth $350/day at age 80.

With 5% simple interest a daily benefit of $200.00 will increase by $10/day on each policy anniversary. For a 55 year old applicant a $200/day benefit with 5% simple will be worth $450/day at age 80.

Generally speaking, most long term care insurance policies no longer offer inflation protection calculated on a simple basis.

I recommend avoiding the simple inflation option if it is offered to you.

Compound Inflation Protection

Compound inflation is better protection for you than is simple inflation.

Compound inflation is interest on interest. Sometimes known as the "8th wonder of the world," compounding interest has a snowball effect increasing your benefits at a more significant pace than simple interest.

Over time, compound inflation protection will provide quite a big difference in benefits than what simple inflation protection will provide. Compound inflation is important for individuals in their 40's, 50's and 60's where it is reasonably projected that your claim is at least 20-30 years away.

For a 55 year old applicant, a $200/day benefit with 5% compound inflation will be worth $677/day at age 80.

For a 55 year old applicant, a $200/day benefit with 4% compound inflation will be worth $533/day at age 80.

For a 55 year old applicant, a $200/day benefit with 3% compound inflation will be worth $418/day at age 80.

3% compound inflation protection is the most popular inflation protection option elected by purchasers of long term care insurance today.

Additionally, LTC insurance policies that afford State LTC Partnership Medicaid asset disregard benefits are required to include compound inflation protection.

Indexed Linked Inflation

Hybrid long term care policies can sometimes be issued as an Indexed Universal Life LTC insurance policy. We will strongly recommend avoiding using IUL policies for long term care planning. IUL policies are typically marketed and sold with illustrations using credited interest based upon initial non-Guaranteed Caps and crediting percentages. The insurance company reserves the right to change the crediting elements within the policy. Guess what, they will. Do not buy a long term care policy that is not guaranteed, and gives the insurance company the right to change the terms and the results of your contract. Buy a contract with guaranteed inflation protection only.

No Inflation Protection or Simply a "Future Purchase Option" or a "Guaranteed Purchase Option"

Many policies do not contain any inflation protection, or simply gives the policy owner a "future purchase option" to buy more coverage at a higher price in the future.

New York Life and Northwestern Mutual are two insurance companies where it is common for its agents to sell policies to consumers with Purchase Offers only. Northwestern Mutual will refer to the is option as Automatic Additional Purchase Benefit (AAPB). New York Life will refer to this option as CPI-U or CPI Offers.

Please do not confuse "AAPB", "Guaranteed Purchase Options" or "Future Purchase Options" or "CPI Offers" with automatic inflation protection. It is simply a sneaky way for agents of insurance companies to lead you to believe that you have automatic annual inflation protection, when you only have a right to buy more coverage at a much higher price (astronomically higher) as you grow older.

Agents usually play this game because they know their company's price with automatic inflation protection is very high, and you will not buy their policy from them if they quote this price to you.

The New York Life (AARP) agent is most guilty of this sales tactic in my 26 years of experience.

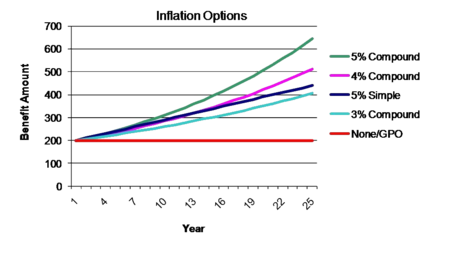

Here is a chart comparing inflation protection. You can see why compound inflation factor is important if you are buying long term care insurance in your 40,'s 50's, or 60's.

| Age | 5% Compound | 3% Compound | Purchase Option |

| 55 | $6000 | $6000 | $6000 |

| 60 | $7657 | $6955 | $6000 |

| 65 | $9773 | $8063 | $6000 |

| 70 | $12,473 | $9347 | $6000 |

| 75 | $15,919 | $10,836 | $6000 |

| 80 | $20,317 | $12,562 | $6000 |

| 85 | $25,931 | $14,563 | $6000 |

| 90 | $33,095 | $16,883 | $6000 |

Purchasing Long Term Care Insurance Inflation Protection

The importance of buying long term care insurance coverage with inflation protection cannot be overstated for you.

Either the issue of rising healthcare costs must be addressed by your plan, or an ever-increasing amount of co-insurance must be accepted by you in the future. If inflation protection is purchased it is important to understand the differences and the long-term effects of each option.

One cautionary note: Many employer sponsored group long term care insurance policies do not offer automatic inflation protection as an option. With employee worksite marketing, often the goal of human resources employee benefits consultants is to sign up as many employees as possible. Thus, the incentive for the enroller is to present to the employees the cheapest price possible to garner as many sign-ups as possible. For this reason, a group long term care policy might be problematic and are "ticking time bombs", so to speak.

Most employees enrolling in group plans are in their 40's or 50's. Thus, the lack of availability of automatic compound inflation rider within the group long term care policy is a significant issue considering younger policyholders need this benefit more often than not.

I also see automatic inflation protection not included in the majority of AARP New York Life long term care policies that are marketed today.

With NY Life, the Purchase Offers are generally only included by the NY Life agents, not automatic inflation.

This is also a price driven decision by many AARP NY Life agents because the AARP NY Life policy is not currently competitively priced within the marketplace to include the automatic inflation protection. The NYL AARP policy is generally twice as expensive as other policies today. So, often we see that the AARP NYL agent will unfortunately not include automatic compound inflation protection solely to try to sell more of its policies.

You need to be fully aware of your options today.

Get Good Advice on Your Long Term Care Insurance Inflation Protection Choices

More than any other benefit, we see the vast majority of long term care insurance mistakes revolve around the inflation protection benefit election.

To learn more about your various long term care insurance inflation options and to ind out which policy inflation protection option makes sense for you, please give us a call toll free at 1-800-891-5824. Or complete our online quote request form.

We are here to answer your questions, and to guide you through your options to help you make good decisions.