Call now for your free quote: 800-891-5824

5 Common Buying Mistakes

1. Assuming Group Long Term Care Insurance Coverage is a Good Deal

Do you know that for many people you can often times obtain better benefits for the same or less premium by purchasing long term care insurance outside of an employer or a group setting. Surprised? Here is why.

Individually underwritten long term care insurance policies typically offer significant discounts for being Married or Partnered, and/or being in Preferred health. The Couples discount alone may be up to 40%. Preferred health discounts may be 10% or 15%.

Group long term care insurance policies often do not offer these Marital, Partner or Preferred health discounts. Group long term care insurance policies are typically offered at Standard health rates with no Partner discounts.

Secondly, group long term care insurance policies very often have reduced benefits for home health care and/or care provided in assisted living facilities—typically a reduction of benefit between 25% and 50%.

Finally, for inflation protection many group policies only offer "Purchase Options" to address inflation rather than automatic compound benefit increases.

Individual long term care insurance policies will always provide you the option of receiving 100% of your benefit in all settings....Home Care, Assisted Living, or a Nursing Facility.

Individual policies will always provide you the option of including automatic compound inflation protection. This benefit will help you keep up with rising healthcare costs; as well as allow your policy to satisfy eligibility requirements for your State's Partnership program.

We have reviewed hundreds of group long term care insurance policies from very large employers: AT&T, IBM, Delta Airlines, UPS, and Lockheed Martin, to name a few. Often, an employee can obtain better benefits for less premium by applying for long term care insurance outside of the group plan.

2. Confusing the Two Types of Long Term Care Insurance Inflation Protection

Long term care insurance is typically available with two types of inflation protection:

1) Automatic inflation

2) Future Purchase Option

The biggest mistake long term care insurance buyers under the age of 65 usually make is purchasing a policy that only offers a Future Purchase Option and not an automatic increase factor.

With automatic inflation, your benefits increase every year by your elected factor, say 5% compound per year. Your LTC premium stays level.

With a Future Purchase Option, your LTC premium will start out lower than a long term care policy with automatic increases, but your LTC premium increases when you elect to buy more coverage.

Thus the intital lower premium is Fool's Gold. Your premium will ultimately be much HIGHER if you try to keep up with inflation.

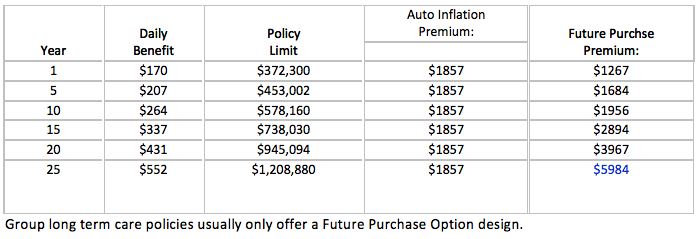

The below hypothetical chart illustrates how the 2 options may differ.

Cautionary Note: many group long term care insurance policies often only offer a Future Purchase Option design.

3. Buying too much or too little coverage.

Long term care facility costs average about $6000/month nationwide. Does this mean you need to buy $6000/month in benefits?

Maybe.

Maybe not.

Costs can vary widely by region of the country.

To find out what long term care costs in the area you plan to retire, click on our Long Term Care Costs of Care Map. Also, please remember that you may have other income sources such as a pension or social security income that can help you to supplement a portion of your long term care costs, as well.

4. Choosing the wrong long term care insurance company

With long term care insurance, you may not make a claim for 20 to 30 years, or longer. Isn’t it important to know that the company you choose will be there in the future to pay your claim, when needed? It may be very important to consider having your coverage with large stable companies with total asset size in the billions, and at least an “A Rating” from AM Best.

Current financial ratings of the leading long term care insurance companies

5. Working with the wrong agent

Most agents have the best intentions for their clients. Agents, however, simply due to a lack of experience or due to limited product access may not be able to provide the best recommendations for consumers. Unlike most agents that only work with 3-4 companies, I have access to all of the leading providers and can help you compare options with leading carriers such as Genworth, Mutual of Omaha, Mass Mutual, New York Life, John Hancock, Lincoln Moneyguard, Northwestern Mutual, State Farm, Pacific Life, MedAmerica, State Life, the Federal Employees Group Plan, Life Secure and more.

To compare your long term care insurance options, and to receive your free long term care insurance quotes please call us toll free at 800-891-5824 today. We promise to answer your questions, as well as to provide you good advice and direction. Let us help you get started today.

Jack Lenenberg, J.D.